Business and Marketing strategies and processes.

Substantive solutions for driven minds aiming to achieve Something.

The Seven Wise Men provides business and marketing strategy consulting services. We assist decision-makers to elevate their strategies and processes at a fraction of the time and costs, and many times the impact and revenues.

Our team provides macro strategies, and the relevant operating processes and structures, needed to execute a chosen strategy and to reach the end-goals.

Despite our dislike for using jargon, we can’t avoid saying that we are specialists in strategic planning, which is the foundation of accurate forecasts and risk prevention. By definition, a strategic plan assists translate a company’s vision into concrete results.

To use an analogy, a strategic plan is like equipping a car with tires. Just as a car without proper wheels faces significant dangers on the road, a business without a strategic plan is vulnerable to existential threats.

With over 30 years of experience in sales and marketing and business strategies and processes, our work has extended to 11 countries in Asia, Eastern Europe, East Africa, and Canada, where we have successfully delivered solutions that target the right segments, differentiate and position products properly, multiply market share and margins, enrich shareholders, motivate employees, and reallocate resources.

The Seven Wise Men is the proud recipient of the prestigious “Excellence in Integrated Marketing Campaigns” award, organized by the Dubai Tourism and Commerce Marketing department (DTCM) in collaboration with the UK-based REED Global.

Expect a cascade of benefits.

- New value creation

- Assets under distress turnaround

- Operational efficiencies

- Risk prevention and containment

- Turnkey business solutions

- Financial turnaround

- Corporate transformation (B2B/B2C)

Trusted by top companies.

Why us.

A focused range of services

We only focus on developing strategic business plans in a variety of industries (without providing services such as M&A advisory, new business set up, digital marketing, company valuations or any other peripheral services).

Fully-integrated solutions

We look at the "Big picture" and also develop detailed action plans that highlight how each program and activity contributes to reaching overall goals.

No testing – No waiting

We Analyze – Plan – Test – Execute – Evaluate. We’ve done all the necessary testing, so that you don’t have to.

Execution of solutions

We assist our clients to implement solutions to guarantee results on-time, as expected.

Service range.

Get precise risk assessment and accurate forecasts in addition to technical and non-technical analyses.

Get precise risk assessment and accurate forecasts in addition to technical and non-technical analyses.

Eliminate broken or inefficient processes that cost your company time and money and harm its image.

Get an action plan with specific objectives and due dates as well as defining who is responsible for doing what and how.

Impress and be impressed with innovative and impactful marketing programs.

Build a strong brand at a fraction of time and cost and many times the impact.

We can assist you to execute solutions and manage projects from start to finish.

Meaningful solutions to complex industrial challenges.

Our process.

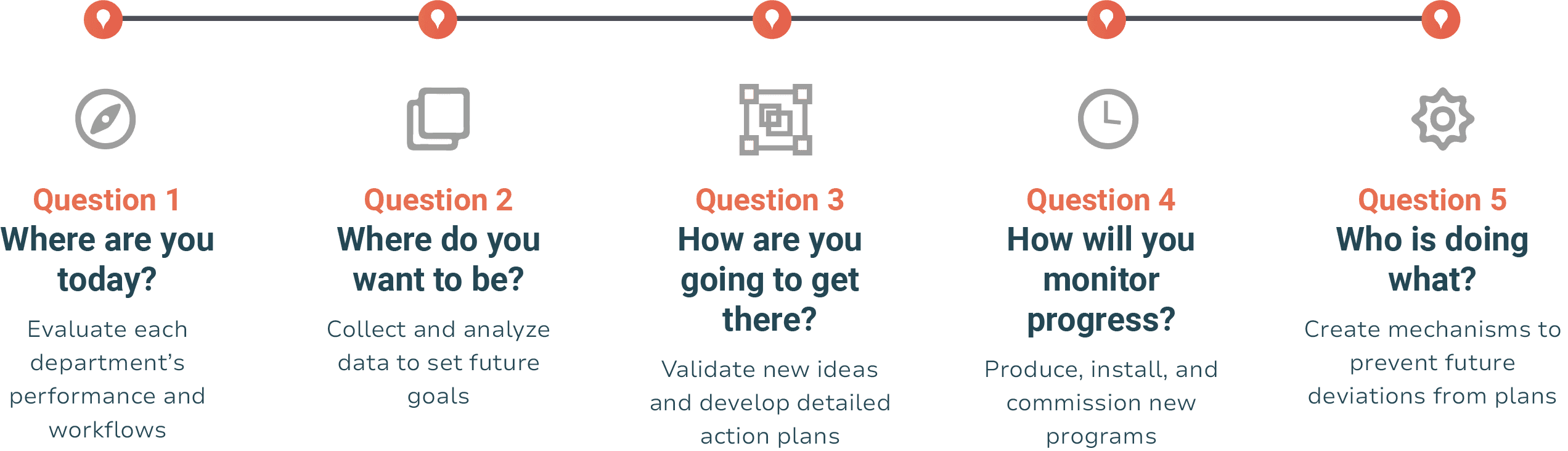

The Seven Wise Men’s strategic plans analyze current and future operating programs and capital investment projects that directly impact shareholder wealth. They answer 5 questions:

An incisive approach honed over 2 decades.

- We fix business, marketing, branding, and product strategies, at board level

- We put in place the right operational processes and mechanisms

- We can assist you to implement solutions

Who needs a strategic plan?

The need for a solid strategic plan is vital for businesses having high staff turnover, or small customer base, under-utilized assets, or high waste ratio.

In addition, managers who spend most of their time “firefighting” problems, and companies that suffer from high cash flow fluctuations, and those that pour money to solve problems without solving them also stand to benefit a lot.

Several other indicators include unsold inventories, small-lot production and low added-value labor, capital, and materials.

A strategic plan can be applied to marketing, brand-building, and the overall state of business.

Whatever sector you operate in, our methodology meets sector-specific requirements (logistics, F&B, manufacturing, and tourism to name only a few).

What we are not.

- We do not have the meltdown-inducing over-confidence of hyper-specialists.

- We do not use jargon or boast flashy backgrounds. We remove the fluff.

Reviews.

Media appearances and Awards.

- CNBC Arabia TV interviews

- Dubai Tourism and Commerce Marketing (DTCM) and Reed Exhibitions (U.K.)

- Media interviews

In a world of promises, we deliver actions and results.

Work with world-class strategy planners who have profound insights on Eastern and Western audiences.

Ask for your free consultation and proposal.

- Recognized brand-builders

- Winners of a prestigious international award

- Specialists in strategic planning and process improvement

- Talented and skilled broad thinkers